Saving today to pay for healthcare expenses when you retire is an integral component of preparing for retirement security. The Retirement Medical Savings Account (RMSA) provides you with a tax-advantaged account specifically to save and invest now for your future retiree healthcare expenses. After-tax contributions are invested, accumulate and disbursed tax-free. To further help you meet your retirement healthcare goals and diversify your investment options, an update will take place in the RMSA on or about June 6, 2022.

Expanding your investment options

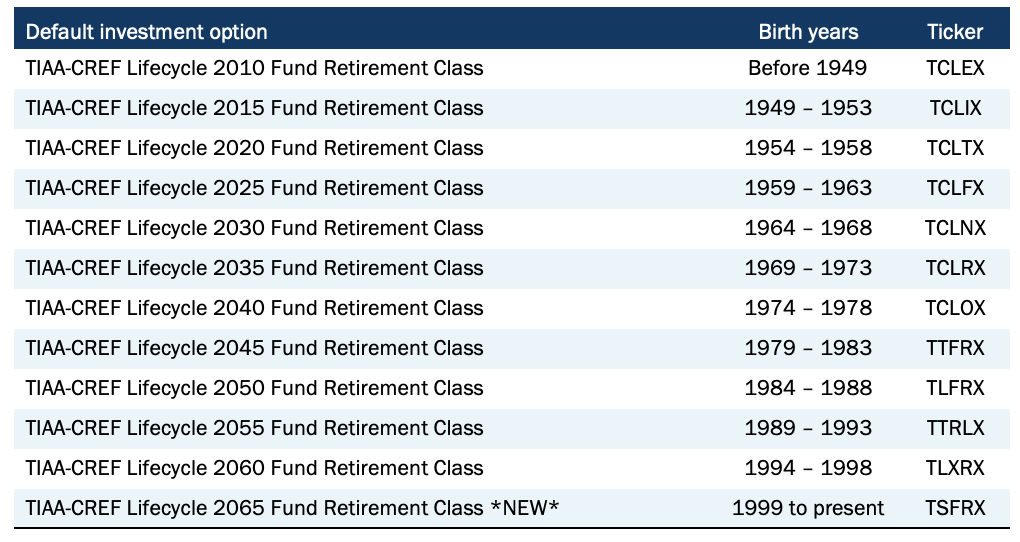

The TIAA-CREF Lifecycle 2065 Fund Retirement Class (TSFRX) is being added as an investment option. You will be able to elect to have future contributions invested in or transfer amounts into this new fund beginning June 6. If you have just enrolled in the plan and have not selected investments, your future contributions will be directed to the lifecycle fund based on your projected retirement date (assuming a retirement age of 65).

What are lifecycle funds?

A lifecycle fund is a “fund of funds,” primarily invested in shares of other mutual funds. The fund’s investments are adjusted gradually from more aggressive to more conservative as the target retirement date approaches. The principal value of a lifecycle fund isn’t guaranteed at any time, including at the target date, and will fluctuate with market changes. Lifecycle funds share the risks associated with the types of securities held by each of the underlying funds in which they invest. The target date represents an approximate date when investors may plan to begin withdrawing from the fund. However, you are not required to withdraw the funds at the target date. After the target date has been reached, some of your money may be merged into a fund with a more stable asset allocation. Also, please note that the lifecycle fund is selected for you based on your projected retirement date (assuming a retirement age of 65).

In addition to the fees and expenses associated with the lifecycle funds, there is exposure to the fees and expenses associated with the underlying mutual funds, as well.

Managing your RMSA

To review your RMSA, please call TIAA at 877-554-1004 and select option 1, weekdays, 8 a.m. – 10 p.m. (ET). Or you can log in to the TIAA website at TIAA.org.

Once you have logged in, you can:

- Review your account balance.

- Make investment allocation changes.

- Obtain performance information.

- Update your personal information.

- Sign up for eDelivery.

- Transfer money from other investments into the TIAA-CREF Money Market Fund, the option from which all claims on qualified medical expenses are paid.

- Make fund transfers among investment options at any time in amounts of $1,000 or more, or the full value of your account (if less than $1,000).

- Set up systematic transfers (minimum $100) between investment options at any time.